Changing Tracks: The Evolution of UK Railways in a Consumerist Era

28th March 2024

Spatial Analysis of the UK's Railways

The UK’s rail network, just like the UK's retail network, is a dynamic commercial landscape. With the changes in remote and hybrid working, the growing popularity of e-commerce, as well as rail strikes and the growth in electric vehicles, the need for adaptation and growth in rail is clear. In this blog, we discuss the distribution of train stations and the potential ways to encourage train use in the UK, using MVPLUS.

The History of Rail

The British Railway system started with humble local isolated wooden wagonways in the 1560s, which by the late 18th century turned into a web of local rail links operated by private railways companies. By the 1840s these solitary links transformed into a national network, still run by multiple competing companies. Over time these condensed into a handful of larger rail companies.

In 1830 the Liverpool and Manchester Railway opened, as the first modern railroad in the UK. It set the mould for railway, as the first to have scheduled services, terminal stations and services, and carrying both freight and passengers.

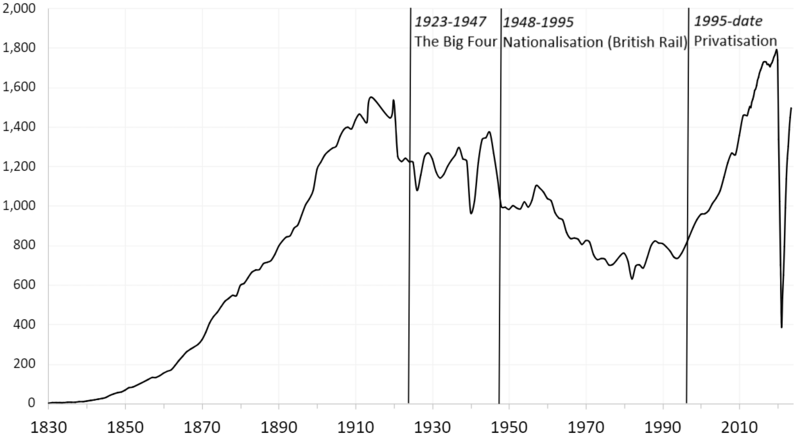

The government brought the entire network under their control during the First World War, and after this only the Big Four of Railway were left to run the network. From 1948 the Big Four were nationalised to form British Railways, under government control. Between 1994 and 1997, British Rail was privatised, after the government argued privatisation would improve passenger services and help the economy.

Through all this, rail was essential for moving people and freight for personal and business uses, but as the UK’s industrial sectors transformed and shrunk, the movement of people became the more common use of rail.

What Are The Challenges To Rail?

COVID-19

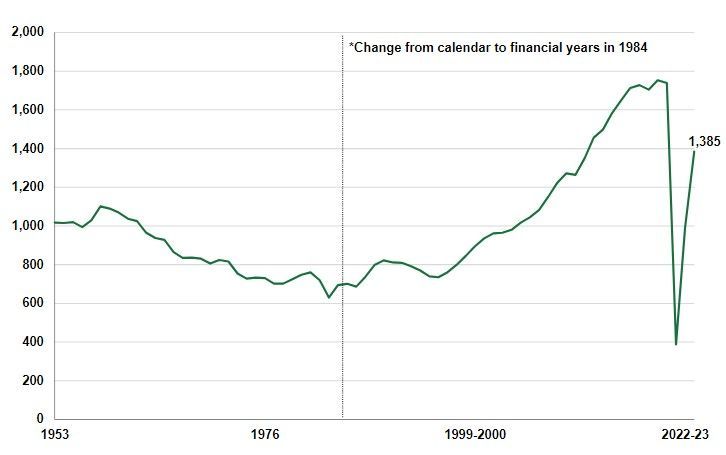

As shown by Figure 2 , before COVID-19 long-term rail demand was increasing. However, during and after COVID-19 this pattern has slowed, although recent trends suggest an increased use of rail with more companies working more days in the office.

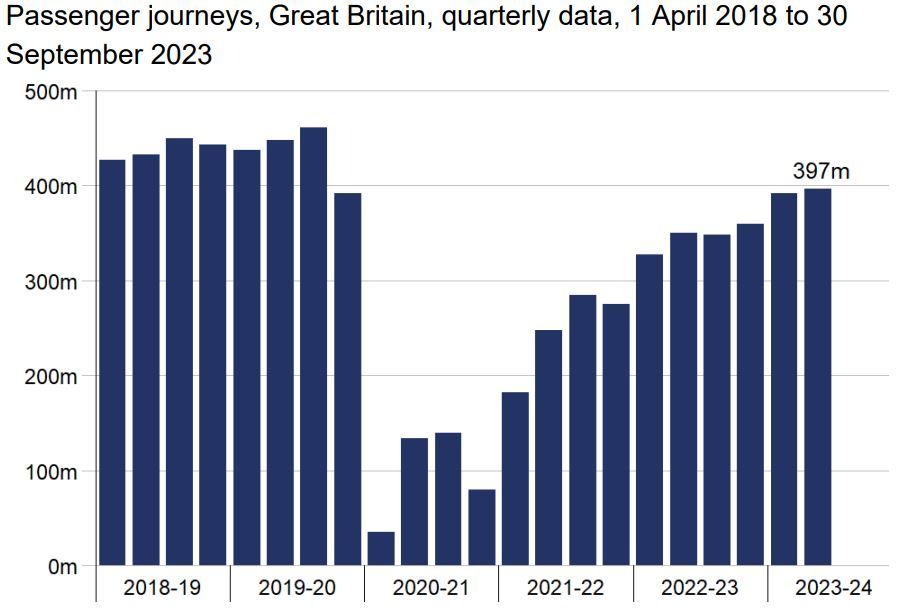

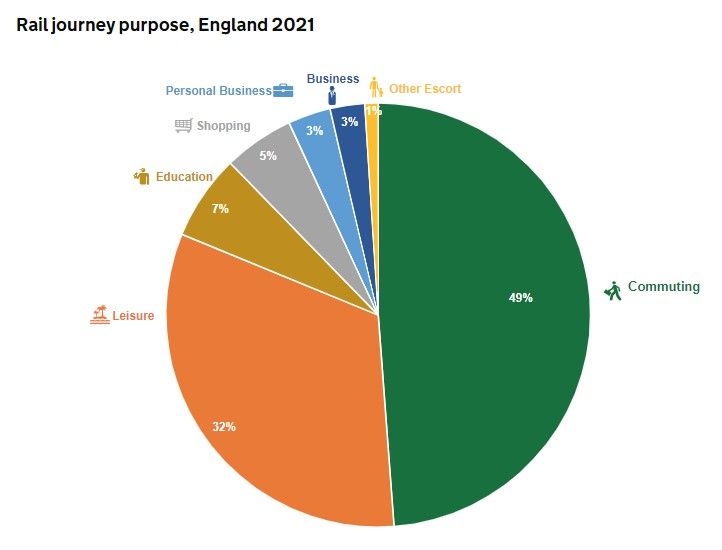

Figure 4 shows that in England in 2021 , almost half of all rail journeys were for commuting. This in hand with the 2024 statistics, which estimate that only 30% of UK companies are working fully on-site today, as opposed to 57% pre-COVID, highlight a potential challenge for maintaining a successful and profitable rail. The recent 2023 GOV.UK report explains that although 1,385 million passenger rail journeys were made in FYE March 2023, an increase of 39.9% on the previous year, this was a decrease of 20.4% on the FYE March 2020. However, as Figure 3 shows, passenger journeys have increased in 8 of the last 10 quarters, and although passenger journeys are not back to pre-pandemic levels, they are rising steadily towards them.

This suggests that the rail industry needs to take action to hold on to its current commuters and encourage growth in this area, but also potentially focus on those other purposes such as leisure and education, and ensure these purposes are marketed and therefore grow, as commuting lessens throughout the next few years.

E-Commerce

As more and more people have access to technology, the use and reliance on e-commerce rises. In fact, in 2023, the UK was predicted to have nearly 60 million e-commerce users , leaving only a minority as physical store only buyers. This change in retail habits means that the retail spaces in and around train stations will need to strategise.

A few of these potential strategies could be:

- Having Click and Collect for various shops – clothing/grocery/presents, at train stations. Finland’s state-owned postal service Posti, has opened a new “click and collect” concept called Box in Helsinki which offers this service.

- Having rooms for meetings, conferences and collaborative working in train stations.

- Investing in the food industry. One of the predicted trends for 2024 is that train stations will be the new food destinations. With train delays and strikes as well as the want for bespoke food and drink, train stations can really become part of the destination if they plan well.

In fact, rail could learn a lot from retail, in particular to tackle the areas of loyalty and engagement. The more modern ideas of encouraging customer and business to collaborate for mutual benefit, and for businesses to sell an immersive or unique experience, could help to revitalise the rail industry.

Location Analysis of the UK Train Network Provision

Rail simply cannot be everywhere!

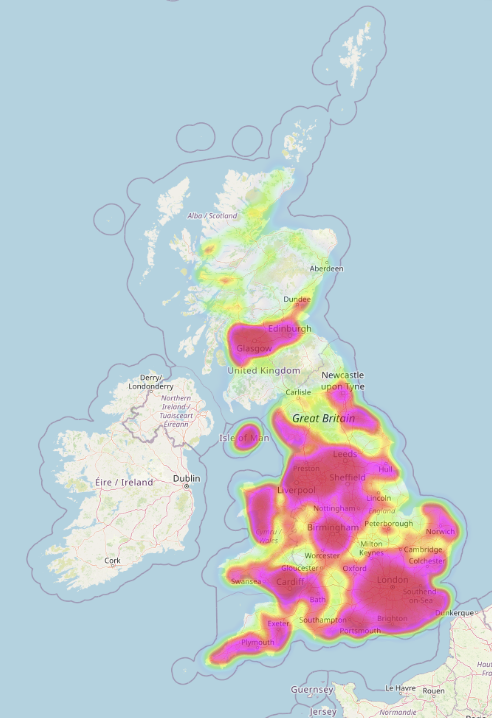

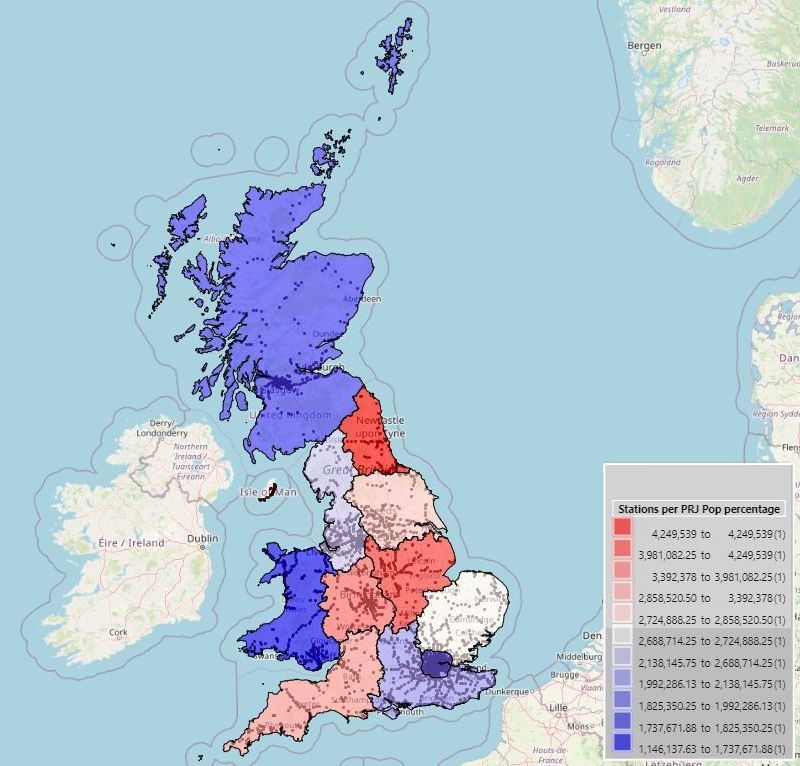

In the MVPLUS maps below we visualised the percentage of British Train Stations per population at Postcode Sectors in our self-serve location intelligence mapping software, MVPLUS. As you can see, there are clear differences in percentage of people per train station, with the London M25, Wales and Scotland Standard Regions having over half the amount of people per train station than the North East, East Midlands and West Midlands. Scotland, however, is slightly misleading due to the large rural areas with low population but plentiful train line.

The location and hotspots of train stations in Britain are shown in the hotspot map, revealing that the vast majority of train stations in Scotland are in the south, in a band from Glasgow to Edinburgh.

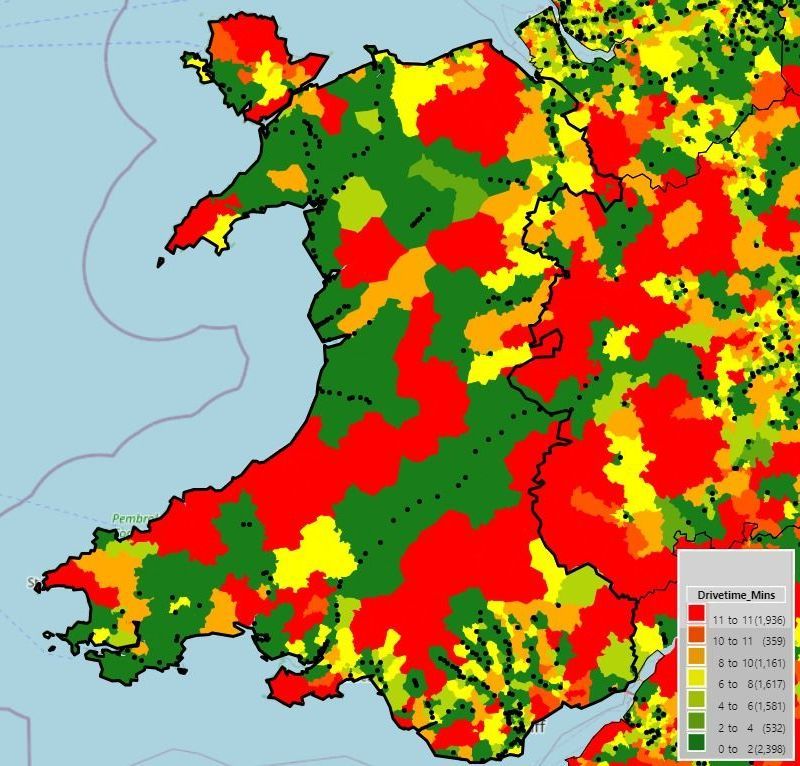

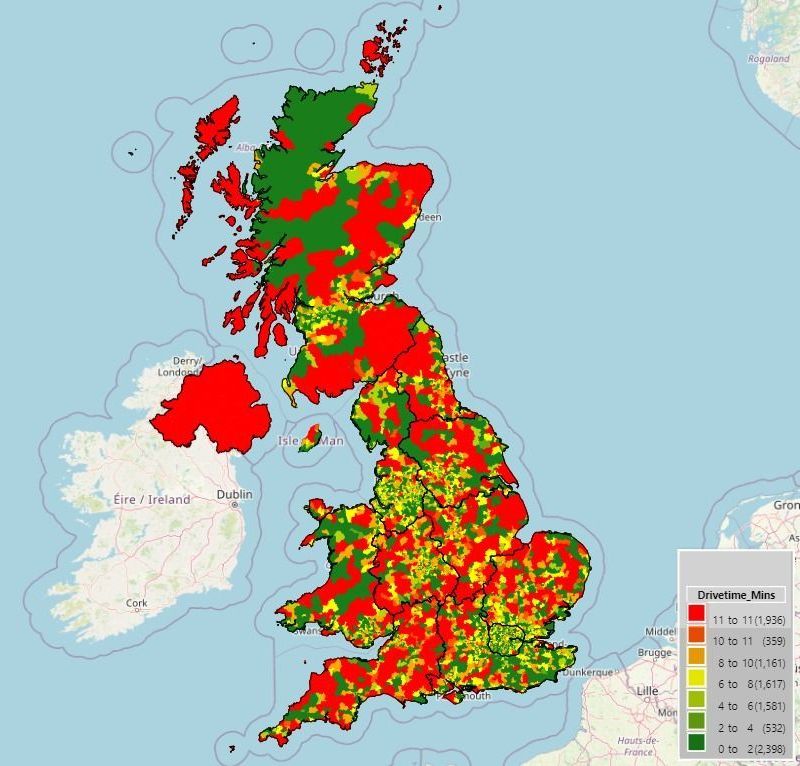

In further analysis we ran 10 minute drive time catchments on the train stations in Britain to assess the different accessibility to train travel for the UK population. The green areas are those within a ten minute drive of a train station, as shown in more detail in the zoomed in map of Wales on the right.

Here you can see a clear band of green along the train line, and therefore the areas where the population have higher accessibility to train travel. The areas in red are those that have the lowest accessibility to train travel. Within Britain, we can see the band of red around the Scottish border without a station nearby. Whereas, the South of England has high train transport accessibility, making it a key housing area for London commuters.

Can you spot any more patterns in the map? Let us know in our LinkedIn post comments.