Another Quarter of UK Electric Vehicle Growth: Will This Continue Without The Tax Exemption?

21st November 2022

There Are Now Over Half a Million BEV’s Registered on Roads in Great Britain

Despite recent turbulence in the global car market, Electric Vehicles have become increasingly more commonplace. Battery Electric Vehicle (BEV) sales have continued to grow. With more manufacturers releasing BEV models and sub-brands, as well as consumer demand for these models increasing, sales of BEV vehicles have grown strongly in relation to traditional internal combustion engine (ICE) vehicles. In Great Britain, there are now more than 550,000 BEV’s registered on the roads!

At GMAP, we have used the most recently available DVLA data

of vehicle registrations to investigate how BEV’s have grown versus ICE vehicles as well as to provide insight into brand market share. Please note, we have solely focused on BEV’s and this analysis does not include PHEV’s or hybrids.

One in Five New Cars Sold is a Battery Electric Vehicle

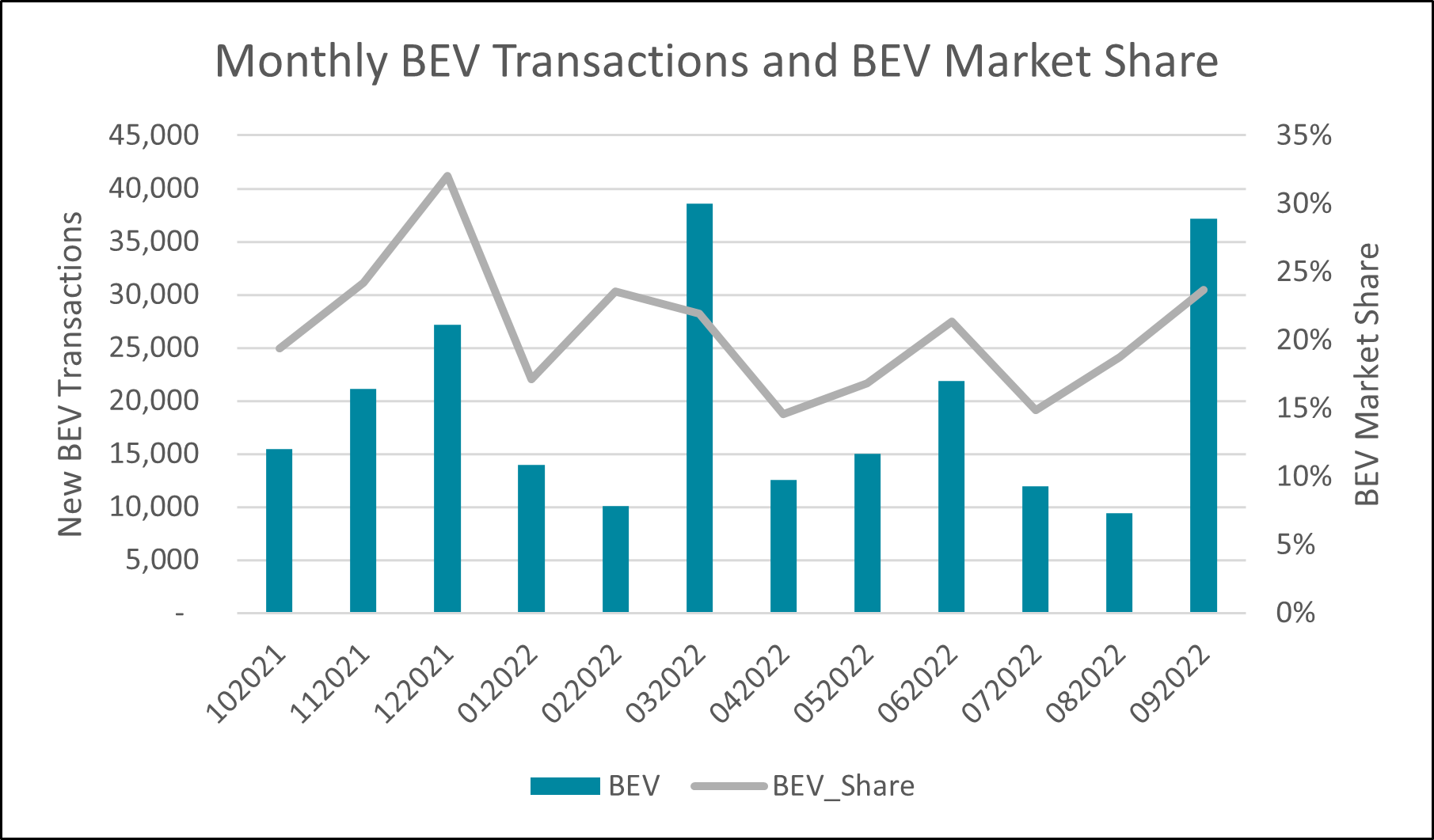

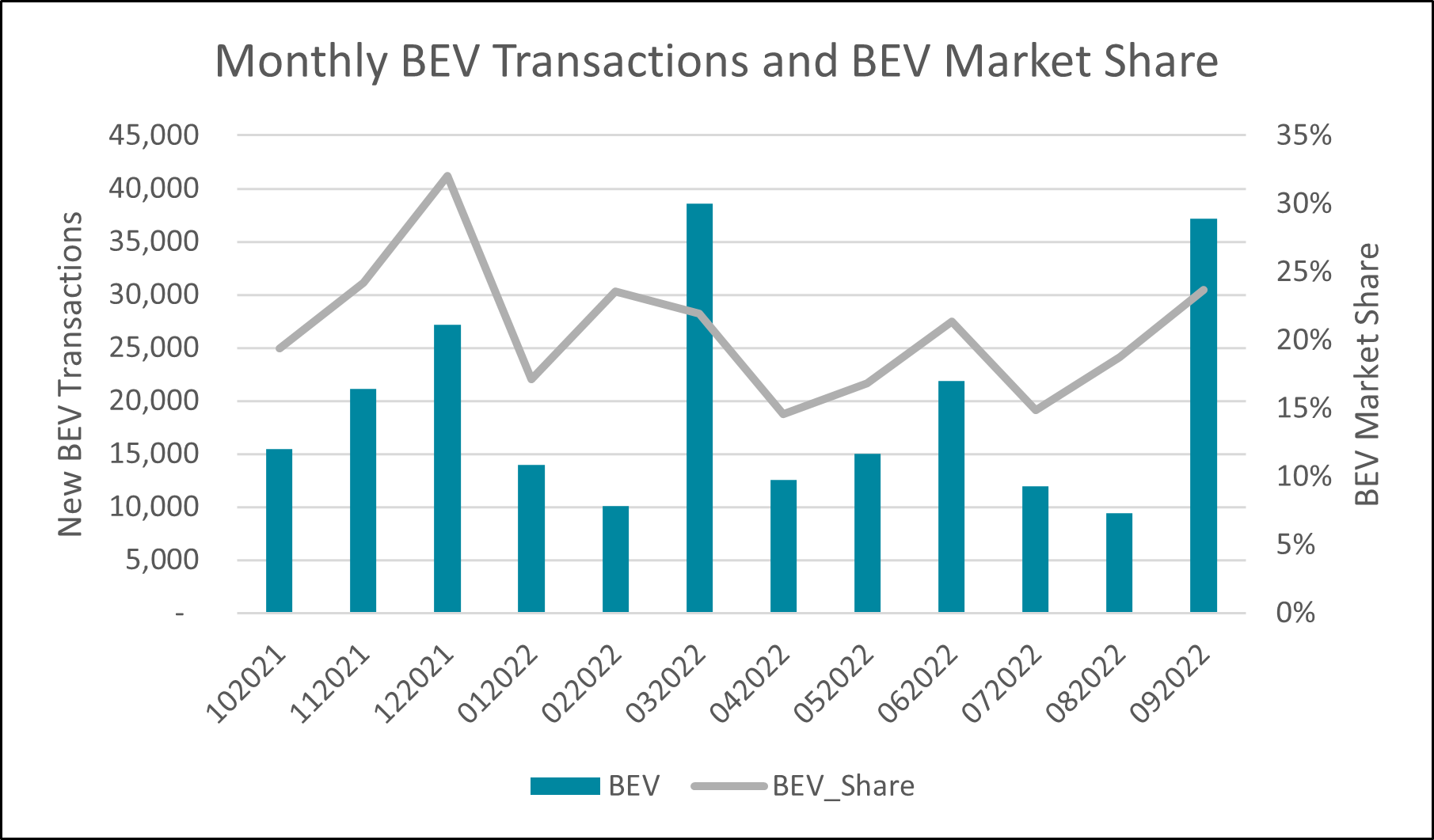

Based on Q3 2022 new car registrations data, 20% of new cars registered were BEV’s in comparison to Petrol and Diesel models. Petrol still dominates new car sales, accounting for almost 70% of new car sales, with Diesel making up the remaining 10%. This trend has remained stable throughout 2022 with BEV’s consistently making up around 20% of the market quarterly. In the month of September, new BEV volume was the 2nd highest month in 2022, with March being the highest. March and September, witnessed the highest combined numbers of registrations for Petrol, Diesel and BEV’s in 2022, but BEV still maintained its share and actually surpassed 20% share in both of these months.

The below chart shows the number of new BEV registrations as well as the BEV market share in comparison to ICE vehicles for the last 12 months (October 2021 to September 2022).

Interestingly, as seen on the chart, the highest BEV share in the last 12 months was in December 2021. In comparison to ICE, BEV’s achieved over a 30% share of the new car market in this month.

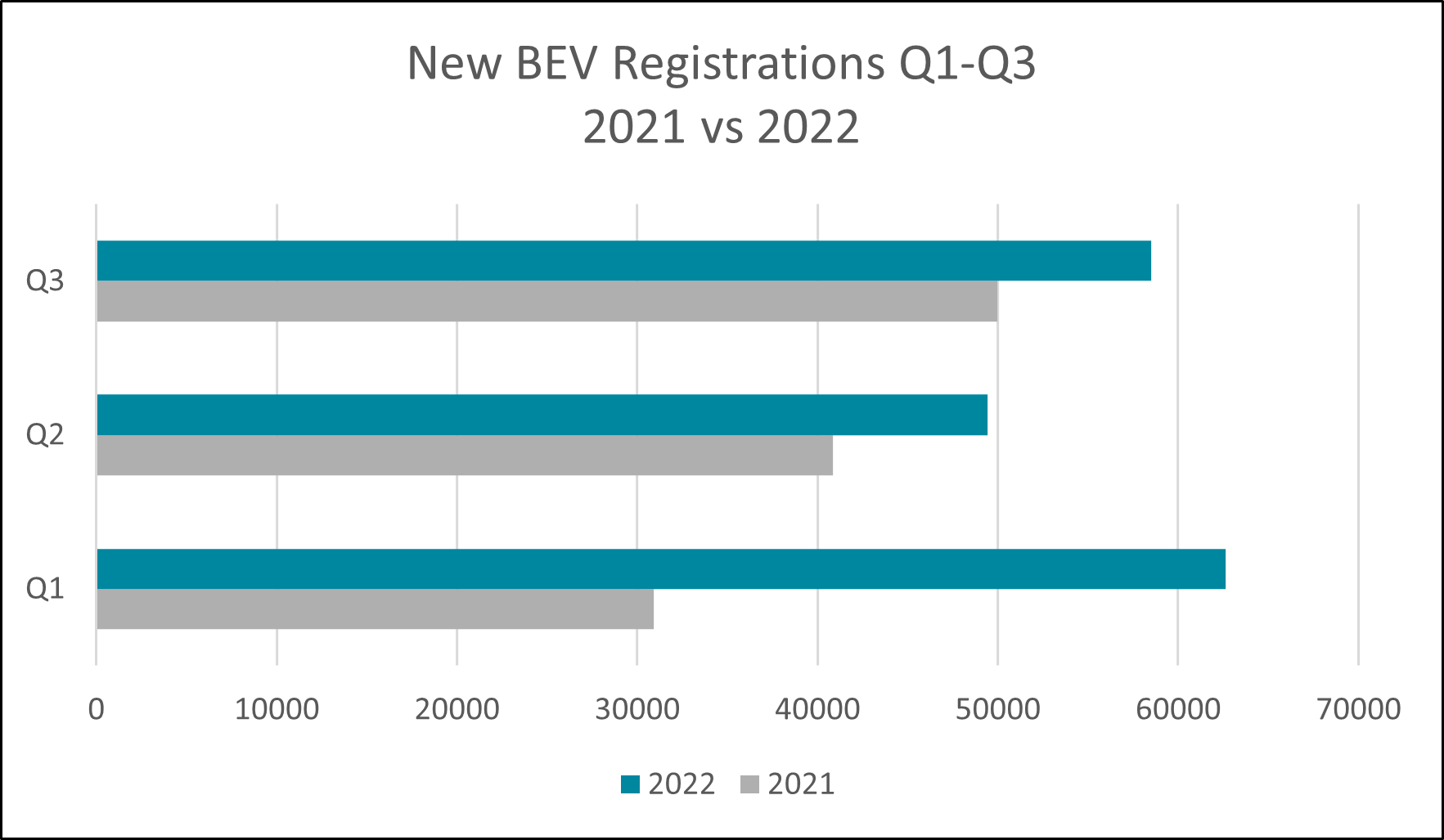

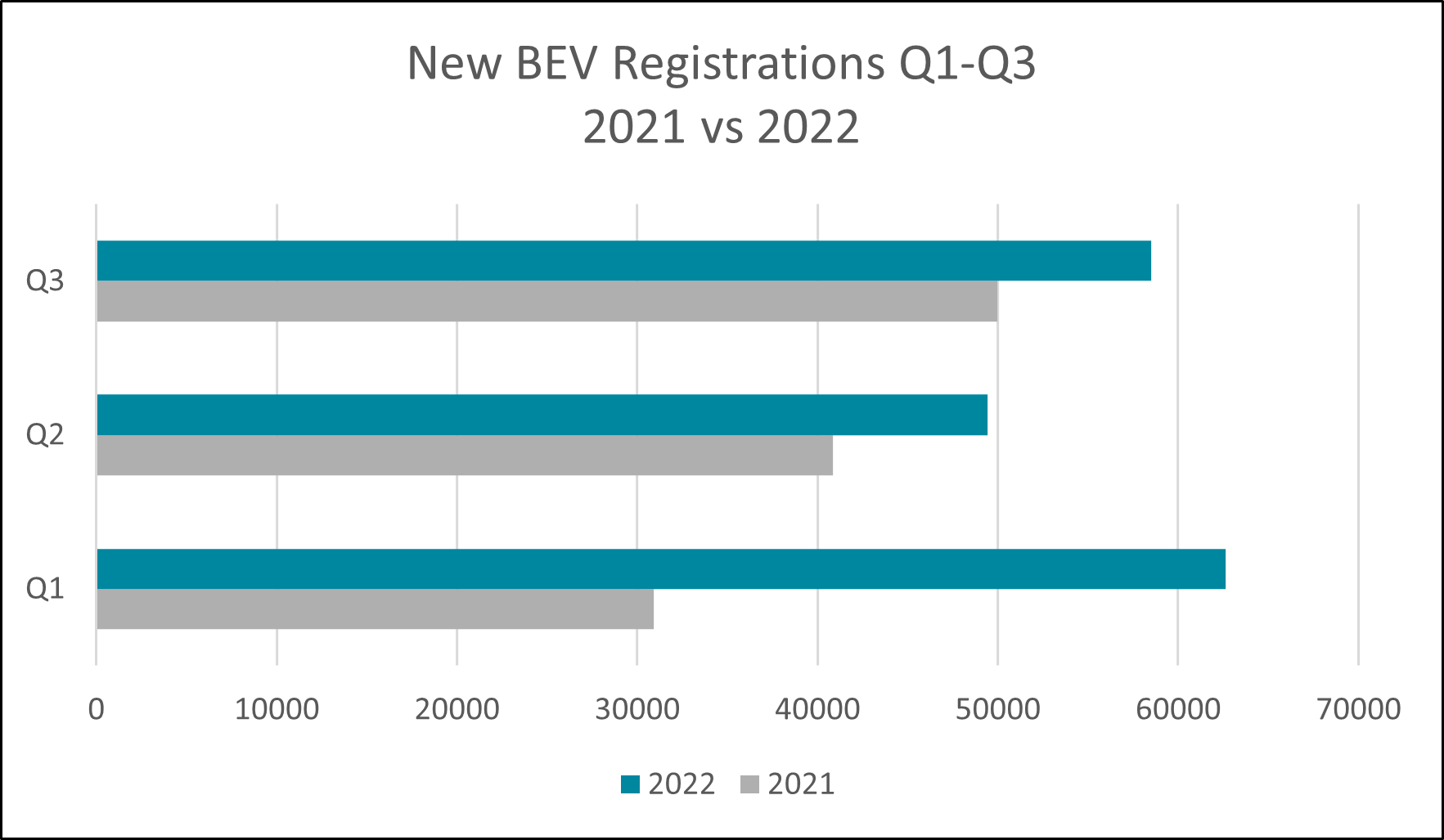

If we look at this year on year, comparing January to September for 2021 vs 2022, the rapid growth of BEV registrations is clear. Although this may not be a clear indicator of demand due to recent market challenges brought on by the pandemic and a global semiconductor shortage, new BEV volume is up around 40% in 2022 compared with 2021. Most of this growth occurred in Q1 with Feb 2022 volume being almost triple that of Feb 2021 and Jan 2022 volume being more than double of Jan 2021. In 2021, Jan and Feb had the lowest BEV volume for the year, this is likely due to widely reported market challenges. March witnessed a healthy increase and the new BEV market recovered well throughout 2021.

The YoY difference between 2021 and 2022 for the period of May to September averaged less than a 20% increase in volume, which is likely to paint a more realistic picture of sustainable market growth. The below chart shows a comparison of BEV registrations in Q1, 2 and 3 for both 2021 and 2022.

Overall, Q1 2022 had more than double the new BEV volume seen in Q1 2021 but this became more comparable in subsequent quarters. It will be interesting to see how Q4 compares once GMAP has the dvla data available in early 2023.

Comparing Battery Electric Vehicle Brands

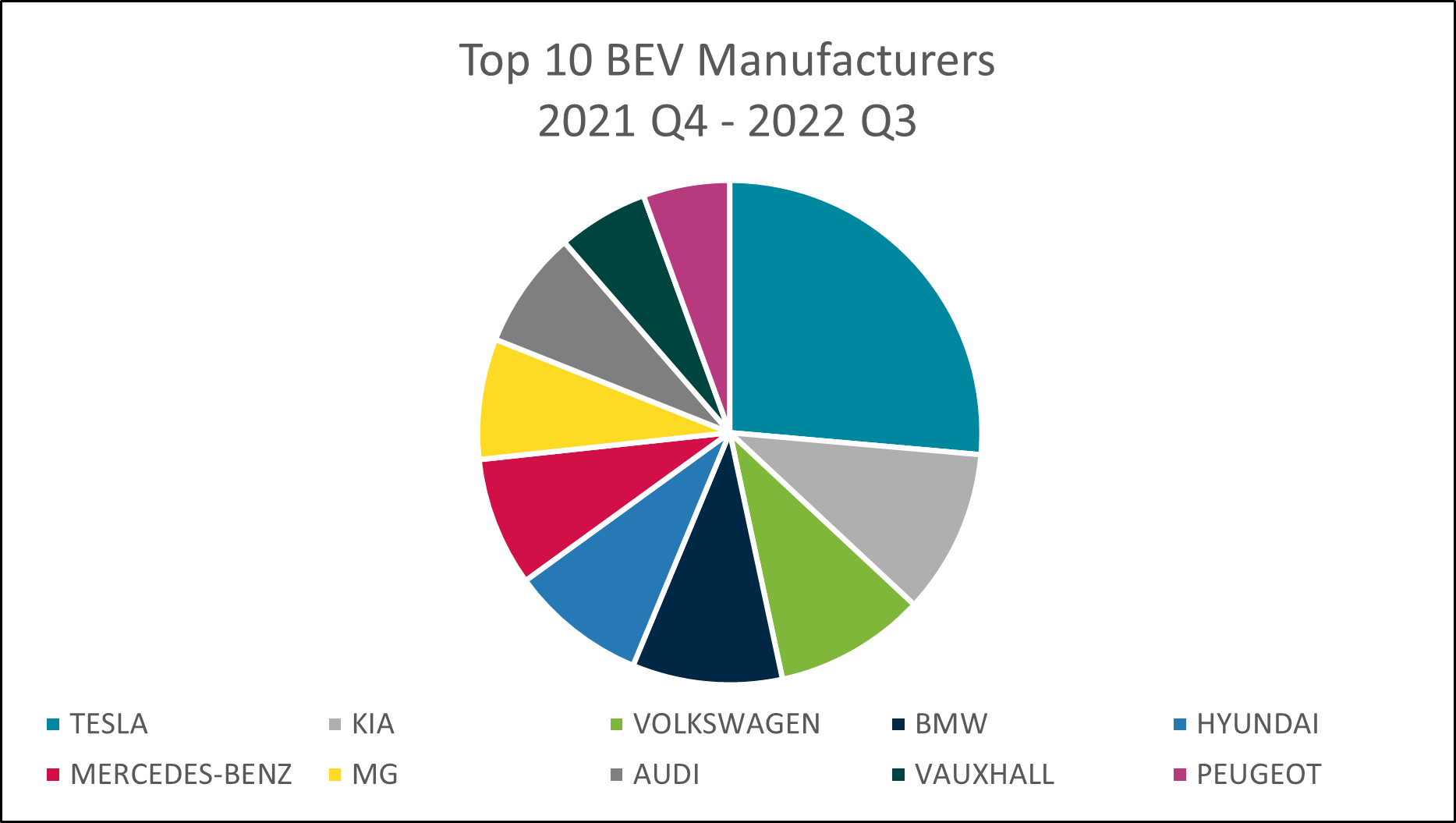

With more manufacturers producing dedicated BEV models and product lines, GMAP investigated how brand share in Great Britain had changed. Tesla is the household name in the electric vehicle market and is widely regarded as the market leader. However, as new brands emerge and OEM’s starting to prioritise the BEV market, has Tesla’s share been affected in recent months?

If we compare the last 12 months of quarterly new BEV registrations, Tesla’s dominance is clear with a market share of almost 20% overall. Tesla was top in each quarter between 2021 Q4 and 2022 Q3. They were the only manufacturer to surpass 10,000 sold BEV units within a quarter, they even surpassed 15,000 in 2022 Q1.

Tesla’s market share has remained relatively stable, except for in 2022 Q2 where it witnessed a sharp decline, when it more than halved from what was observed in 2022 Q1. This allowed other manufacturers to gain temporary market share with the remaining 9 manufacturers that made up the top 10 for BEV sales having more than 58% of the BEV market, higher than what has been seen in other quarters.

MG witnessed large growth in the most recent quarterly data compared to the previous three. From 2021 Q4 to 2022 Q2 it was struggling to break through the 3,000 new BEV registrations threshold, but soon surpassed this in 2022 Q3, increasing far beyond 4,000 registrations with growth of over 40% quarter to quarter.

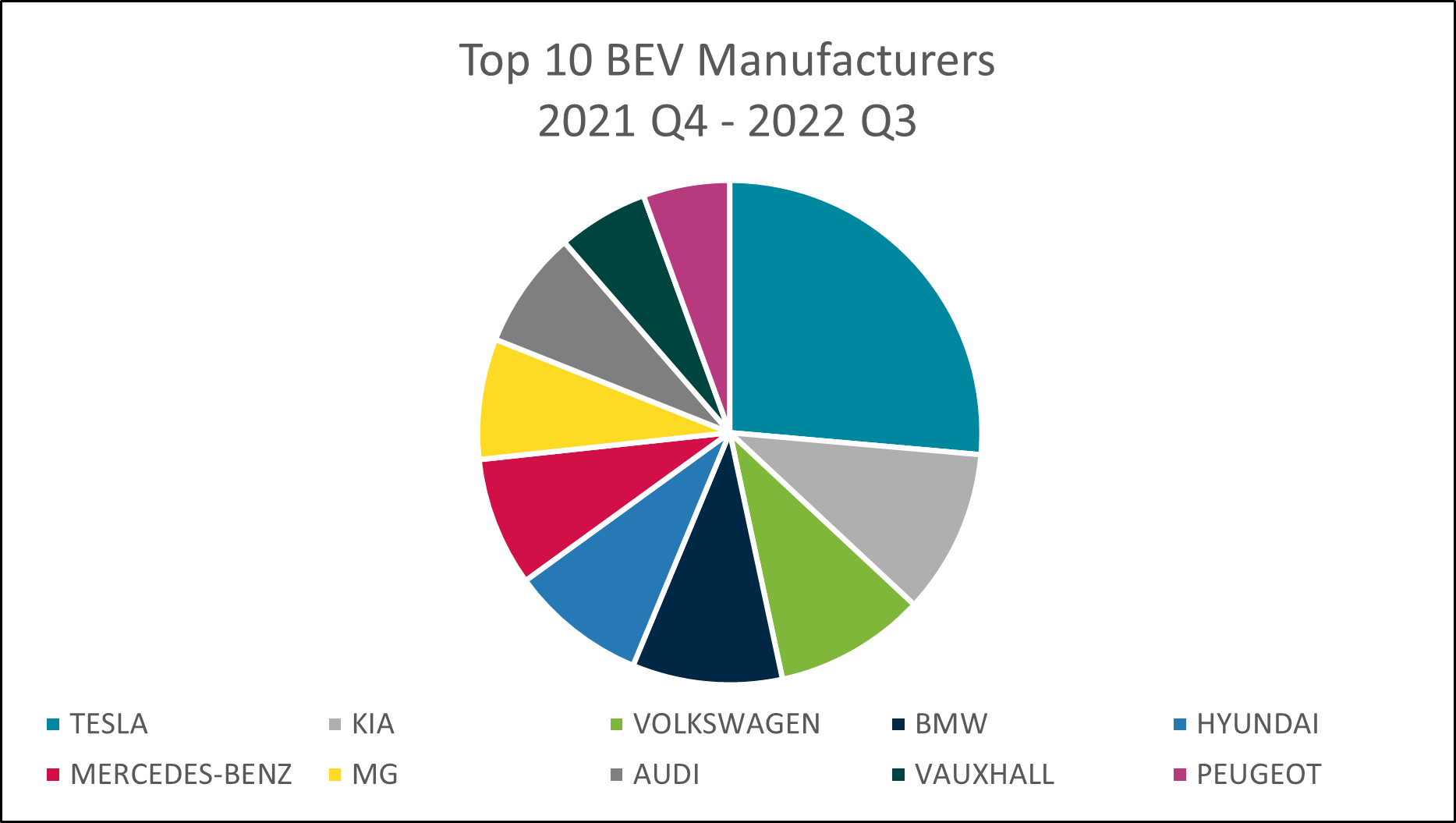

There are close to 40 brands now bringing out BEV models, however the top 10 are responsible for over 70% of the new market. The below pie chart shows how the top 10 is made up:

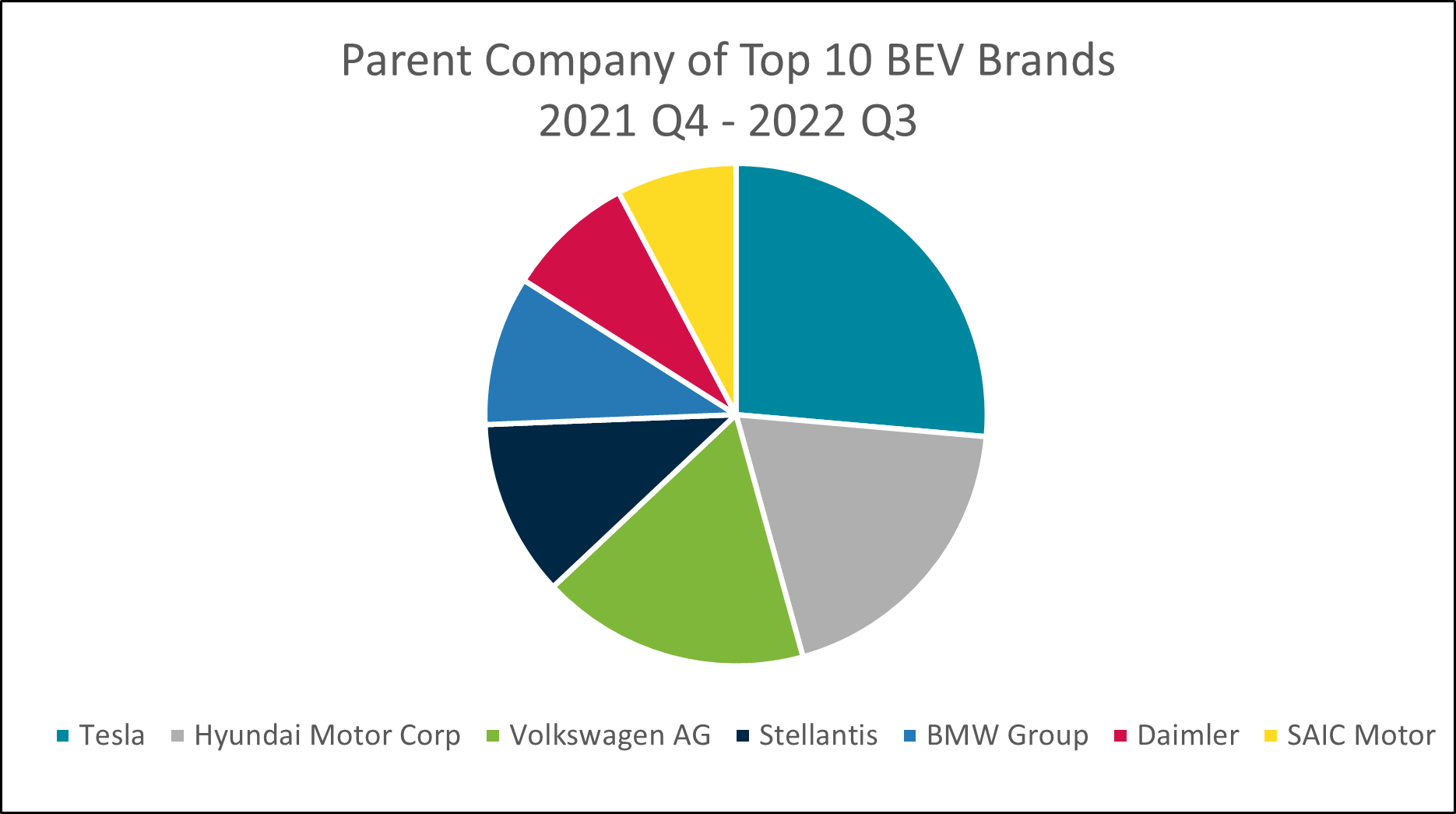

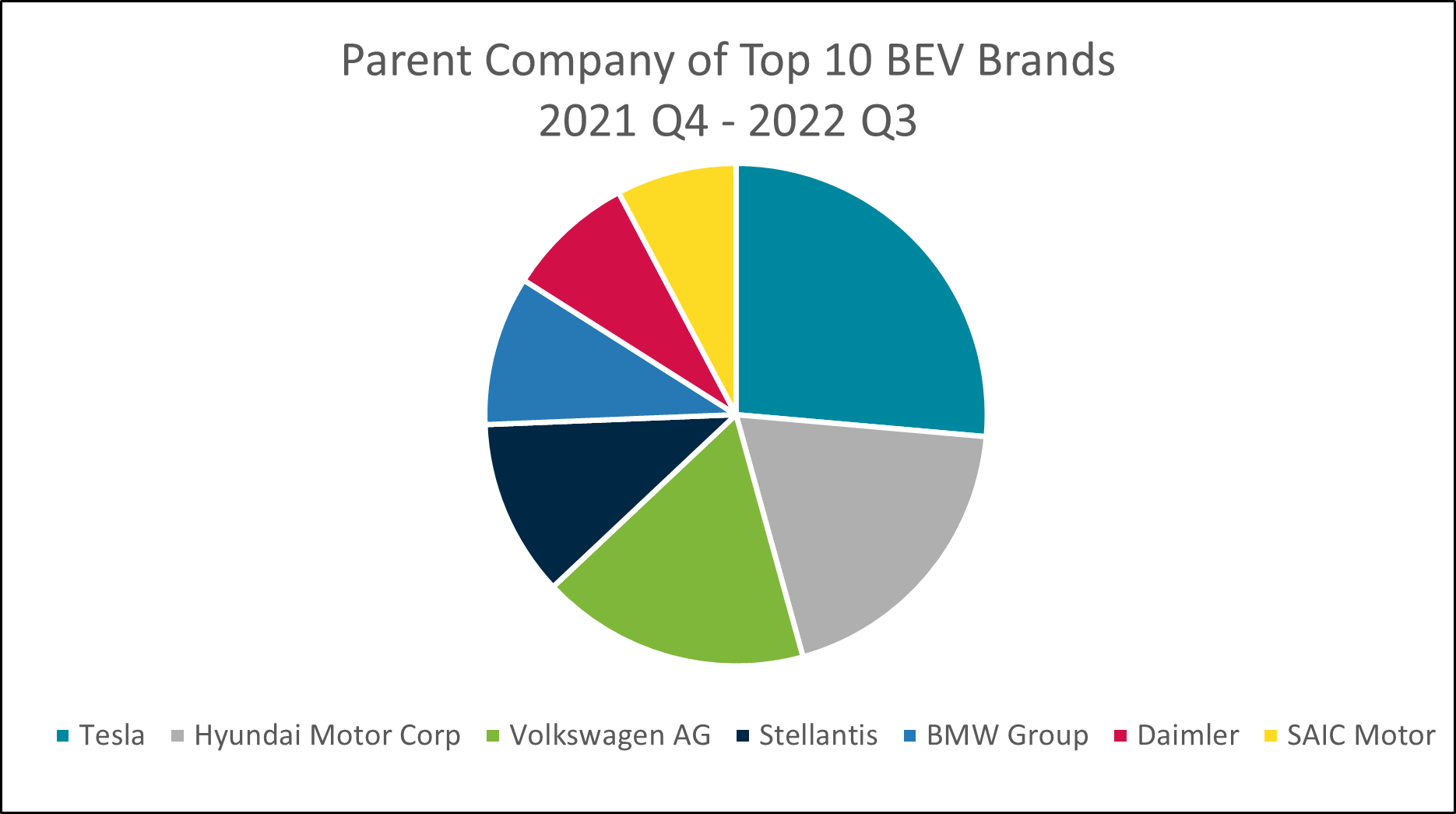

We can then aggregate this to look at how the top 10 brands measure up in terms of their parent group.

It is no surprise to see Tesla forming the largest section of both charts. Hyundai Motor Corp have the second largest share, with Kia being the largest individual brand behind Tesla and Hyundai featuring at rank five. Volkswagen AG are the third largest parent group with Volkswagen and Audi both featuring in the top 10 brands supported by their ID and e-tron ranges respectively. BMW are the fourth largest brand, closely behind Volkswagen in third place, but fall behind Stellantis when looking at this at Parent Group level.

Surprisingly, neither Renault or Nissan are included in the top 10. Both brands were very early entrants into the BEV market with their respective Zoe and Leaf models, however seem to have fallen behind in recent times. Nissan features eleventh place behind Peugeot and Renault are further down in sixteenth.

A brand to certainly keep an eye on is Cupra, part of Volkswagen AG. From looking at our data, they didn’t register a single BEV in 2021 Q4 but have soon accelerated up the rankings, coming in at rank thirteen for 2022 Q3. In fact, their registrations grew by more than 150% between 2022 Q2 and Q3. It will certainly be interesting to see how these newer entrants to the BEV market perform and grow over the next year.

Comparing Battery Electric Vehicle Brands

This piece has been designed to provide a brief overview to the current state of the BEV market in relation to ICE vehicles as well as to investigate brand performance. Comparisons have been made between 2022 and 2021, it is important to note that the global car market has suffered significant challenges and disruption during this time and may not reflect true performance under more stable market conditions.

BEV’s have seemingly cemented their place as the second most common fuel type for new car sales (hybrids excluded) and currently have around twice the market share of Diesel vehicles. Whilst their numbers are still far off matching that of Petrol cars, we can only see BEV’s share of the market increasing. In terms of brands, Tesla is still the dominant force in the BEV market but as more brands and groups produce more dedicated BEV models, Tesla’s share will inevitably start to decrease and the market will become a more even playing field.

Without Electric Car Tax Exemptions, Will This Continue?

In the Autumn Statement on the UK budget on the 17th November, BEV owners will no longer be exempt from paying car tax from 2025 onwards. Will this affect future purchasing behaviour in the Electric Vehicle market?

Access the DVLA Data to Support Your Automotive Location Intelligence

GMAP’s DVLA data

product provides a comprehensive insight into the UK vehicle market, including new and used transactions and vehicle parc. If you feel that our DVLA data

may be of use to you to support your location intelligence activities surrounding the BEV market or anything automotive, then please get in touch at info@gmap.com.

There Are Now Over Half a Million BEV’s Registered on Roads in Great Britain

Despite recent turbulence in the global car market, Electric Vehicles have become increasingly more commonplace. Battery Electric Vehicle (BEV) sales have continued to grow. With more manufacturers releasing BEV models and sub-brands, as well as consumer demand for these models increasing, sales of BEV vehicles have grown strongly in relation to traditional internal combustion engine (ICE) vehicles. In Great Britain, there are now more than 550,000 BEV’s registered on the roads!

At GMAP, we have used the most recently available DVLA data

of vehicle registrations to investigate how BEV’s havegrown versus ICE vehicles as well as to provide insight into brand market share. Please note, we have solely focused on BEV’s and this analysis does not include PHEV’s or hybrids.

One in Five New Cars Sold is a Battery Electric Vehicle

Based on Q3 2022 new car registrations data, 20% of new cars registered were BEV’s in comparison to Petrol and Diesel models. Petrol still dominates new car sales, accounting for almost 70% of new car sales, with Diesel making up the remaining 10%. This trend has remained stable throughout 2022 with BEV’s consistently making up around 20% of the market quarterly. In the month of September, new BEV volume was the 2nd highest month in 2022, with March being the highest. March and September, witnessed the highest combined numbers of registrations for Petrol, Diesel and BEV’s in 2022, but BEV still maintained its share and actually surpassed 20% share in both of these months.

The below chart shows the number of new BEV registrations as well as the BEV market share in comparison to ICE vehicles for the last 12 months (October 2021 to September 2022).

Interestingly, as seen on the chart, the highest BEV share in the last 12 months was in December 2021. In comparison to ICE, BEV’s achieved over a 30% share of the new car market in this month.

If we look at this year on year, comparing January to September for 2021 vs 2022, the rapid growth of BEV registrations is clear. Although this may not be a clear indicator of demand due to recent market challenges brought on by the pandemic and a global semiconductor shortage, new BEV volume is up around 40% in 2022 compared with 2021. Most of this growth occurred in Q1 with Feb 2022 volume being almost triple that of Feb 2021 and Jan 2022 volume being more than double of Jan 2021. In 2021, Jan and Feb had the lowest BEV volume for the year, this is likely due to widely reported market challenges. March witnessed a healthy increase and the new BEV market recovered well throughout 2021.

The YoY difference between 2021 and 2022 for the period of May to September averaged less than a 20% increase in volume, which is likely to paint a more realistic picture of sustainable market growth. The below chart shows a comparison of BEV registrations in Q1, 2 and 3 for both 2021 and 2022.

Overall, Q1 2022 had more than double the new BEV volume seen in Q1 2021 but this became more comparable in subsequent quarters. It will be interesting to see how Q4 compares once GMAP has the dvla data available in early 2023.

Comparing Battery Electric Vehicle Brands

With more manufacturers producing dedicated BEV models and product lines, GMAP investigated how brand share in Great Britain had changed. Tesla is the household name in the electric vehicle market and is widely regarded as the market leader. However, as new brands emerge and OEM’s starting to prioritise the BEV market, has Tesla’s share been affected in recent months?

If we compare the last 12 months of quarterly new BEV registrations, Tesla’s dominance is clear with a market share of almost 20% overall. Tesla was top in each quarter between 2021 Q4 and 2022 Q3. They were the only manufacturer to surpass 10,000 sold BEV units within a quarter, they even surpassed 15,000 in 2022 Q1.

Tesla’s market share has remained relatively stable, except for in 2022 Q2 where it witnessed a sharp decline, when it more than halved from what was observed in 2022 Q1. This allowed other manufacturers to gain temporary market share with the remaining 9 manufacturers that made up the top 10 for BEV sales having more than 58% of the BEV market, higher than what has been seen in other quarters.

MG witnessed large growth in the most recent quarterly data compared to the previous three. From 2021 Q4 to 2022 Q2 it was struggling to break through the 3,000 new BEV registrations threshold, but soon surpassed this in 2022 Q3, increasing far beyond 4,000 registrations with growth of over 40% quarter to quarter.

There are close to 40 brands now bringing out BEV models, however the top 10 are responsible for over 70% of the new market. The below pie chart shows how the top 10 is made up:

We can then aggregate this to look at how the top 10 brands measure up in terms of their parent group.

It is no surprise to see Tesla forming the largest section of both charts. Hyundai Motor Corp have the second largest share, with Kia being the largest individual brand behind Tesla and Hyundai featuring at rank five. Volkswagen AG are the third largest parent group with Volkswagen and Audi both featuring in the top 10 brands supported by their ID and e-tron ranges respectively. BMW are the fourth largest brand, closely behind Volkswagen in third place, but fall behind Stellantis when looking at this at Parent Group level.

Surprisingly, neither Renault or Nissan are included in the top 10. Both brands were very early entrants into the BEV market with their respective Zoe and Leaf models, however seem to have fallen behind in recent times. Nissan features eleventh place behind Peugeot and Renault are further down in sixteenth.

A brand to certainly keep an eye on is Cupra, part of Volkswagen AG. From looking at our data, they didn’t register a single BEV in 2021 Q4 but have soon accelerated up the rankings, coming in at rank thirteen for 2022 Q3. In fact, their registrations grew by more than 150% between 2022 Q2 and Q3. It will certainly be interesting to see how these newer entrants to the BEV market perform and grow over the next year.

Comparing Battery Electric Vehicle Brands

This piece has been designed to provide a brief overview to the current state of the BEV market in relation to ICE vehicles as well as to investigate brand performance. Comparisons have been made between 2022 and 2021, it is important to note that the global car market has suffered significant challenges and disruption during this time and may not reflect true performance under more stable market conditions.

BEV’s have seemingly cemented their place as the second most common fuel type for new car sales (hybrids excluded) and currently have around twice the market share of Diesel vehicles. Whilst their numbers are still far off matching that of Petrol cars, we can only see BEV’s share of the market increasing. In terms of brands, Tesla is still the dominant force in the BEV market but as more brands and groups produce more dedicated BEV models, Tesla’s share will inevitably start to decrease and the market will become a more even playing field.

Without Electric Car Tax Exemptions, Will This Continue?

In the Autumn Statement on the UK budget on the 17th November, BEV owners will no longer be exempt from paying car tax from 2025 onwards. Will this affect future purchasing behaviour in the Electric Vehicle market?

Access the DVLA Data to Support Your Automotive Location Intelligence

GMAP’s DVLA data

product provides a comprehensive insight into the UK vehicle market, including new and used transactions and vehicle parc. If you feel that our DVLA data

may be of use to you to support your location intelligence activities surrounding the BEV market or anything automotive, then please get in touch at info@gmap.com.