Cash Access Oasis or Desert?

14th November 2019

We are seeing the media report more and more on the perils of a ‘Cashless Society’ as vendors and consumers favour digital payments over cash. And who could blame our preference? We constantly strive for ease; and online shopping, contactless payments, and mobile applications give us the immediacy we demand. Consequently, ‘cash only’ accounts for 28% of all payments today; ten years ago, it was 60%. Continuing at this rate means the UK will be cashless by 2026. This forecast, coupled with retail banks having to foot an annual £5 billion bill for ATM infrastructure costs, is challenging the economic model. Therefore, like rising costs have given us smaller chocolate bars, the number of bank branches and ATM’s is reducing.

"'Cash Only' accounts for 28% of all payments today"

Despite our preference for digital payments, 97% of us carry cash. In fact, the average amount is £41! This culminated in 2.4 billion ATM cash withdrawals in 2018, totalling £193 billion. It is no wonder then that a recent UK public opinion poll concluded only 36% of UK adults believed they could cope with going completely cashless. Government advisors are concerned too. They state eight million UK adults (17% of the UK population) would get left behind – just think about the number of cash-in-hand employments: window cleaners, gardeners, labourers, to name a few. Additionally, consumer association Which? fears that deprived neighbourhoods have the least access to cash, even though they are more dependent on it than their affluent counterparts. Thus, it seems the concerns about the so-called ‘Cash Deserts’ are justified, at least for the next 15 years anyway.

In response, LINK – the network that connects the UK’s cash machines and enables universal access to people’s cash – has set up a £1 million fund to pay for 40 to 50 ATM’s requested by residents in the ‘Cash Deserts’. To qualify as a ‘Cash Desert’, areas must not have access to a free to use ATM or Post Office within 1km and the machine must be in a secure locale.

Here at GMAP, we have deployed our MVPLUS

interactive mapping system to investigate how feasible cash access is at postcode level, nationally. To do this we ran a proximity analysis to assess the distance between each postcode and the nearest ATM or Post Office, and appended the 2019 CAMEO

geodemographic dataset to the results. We then compared the 1.4 million households around our locale within the postcode areas of: Bradford (BD), Huddersfield (HD), Harrogate (HG), Halifax (HX), Leeds (LS), Wakefield (WF) and York (YO) to the national picture.

"85% of UK households have an ATM or Post Office within 1km"

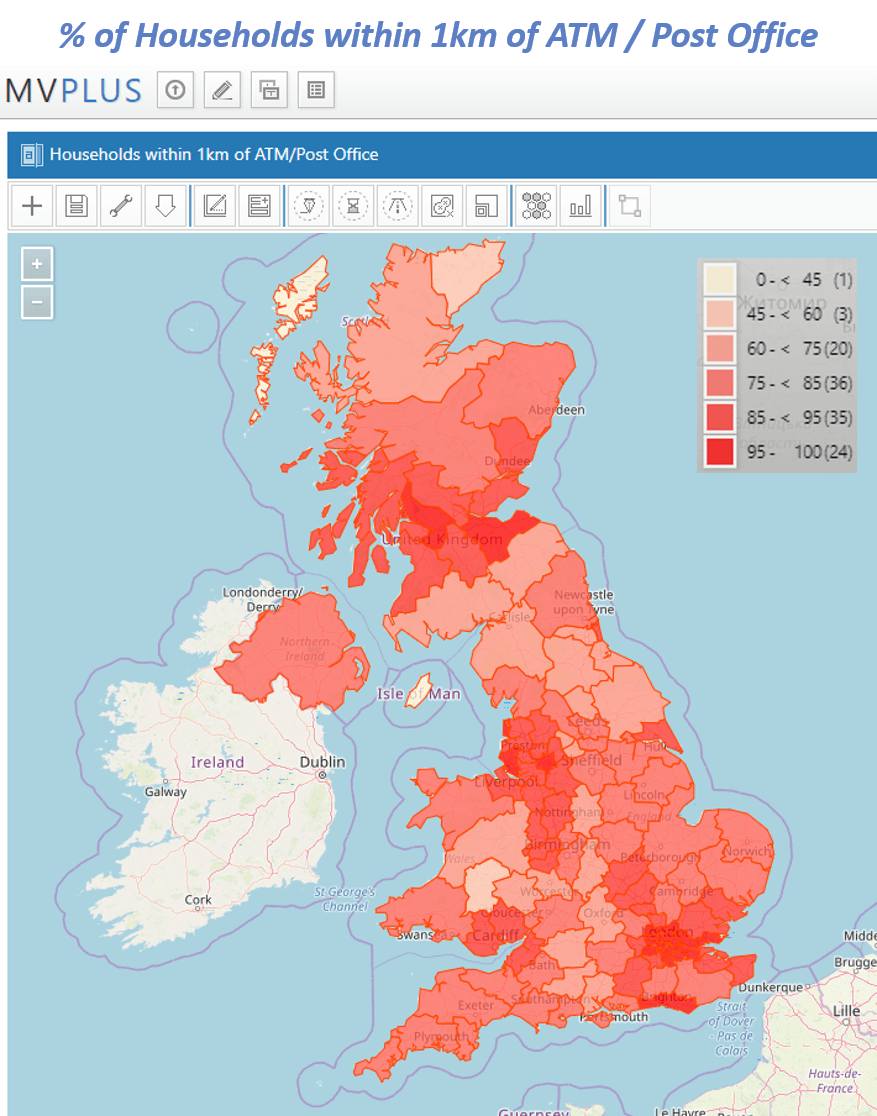

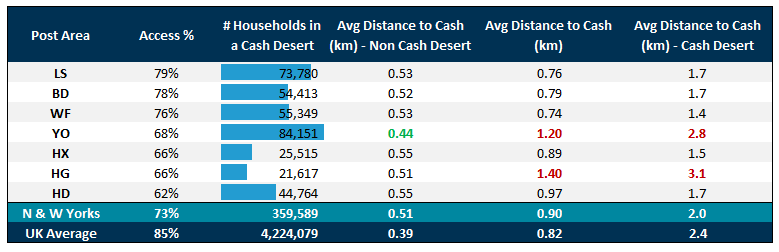

Using LINK’s definition, our data shows that 85% of UK households have an ATM or Post Office within 1km. Not surprisingly, the highest accessibility is within London whilst the most Northern areas of Scotland have the least – 44% in the Northern Hebrides. For our locale, the coverage is below the national average at 73%. This means approximately 360,000 households are classified as ‘Cash Deserts’. For households not in a ‘Cash Desert’, the average travel distance is ½ km across all postcode areas, except for York which is nearer 400 metres. If we look at the individual postcode areas, there is a fair amount of variation; households with a Leeds postcode have the most accessibility to cash at 79%, whilst those in Huddersfield only have 62% - the lowest cash accessibility within England! Interestingly, had LINK set the qualification threshold at 2km, only 6% of households nationally would be in a ‘Cash Desert’ and 8% within our region.

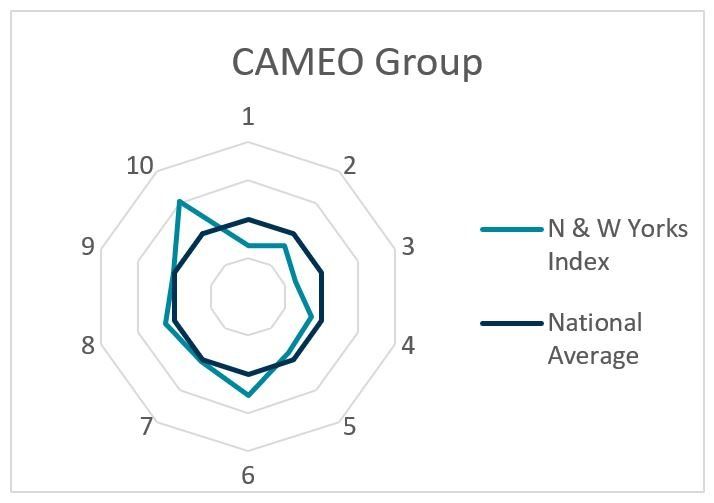

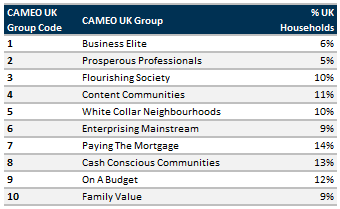

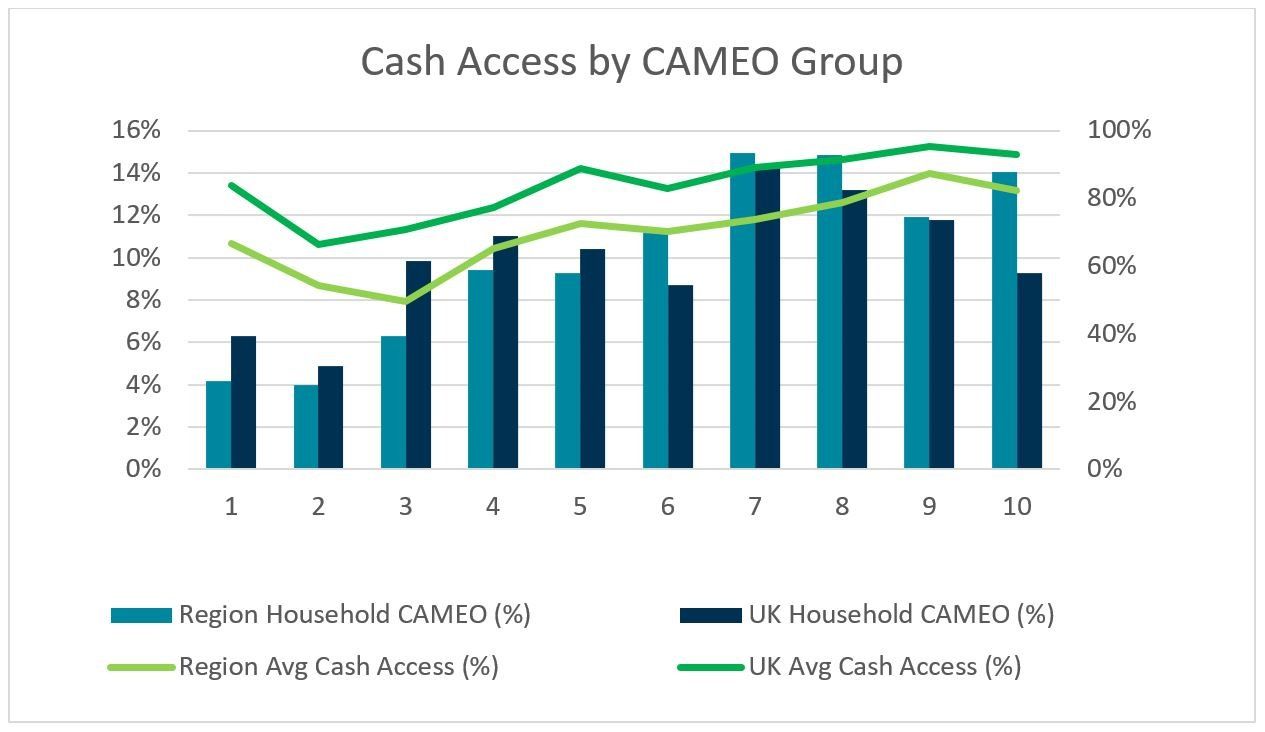

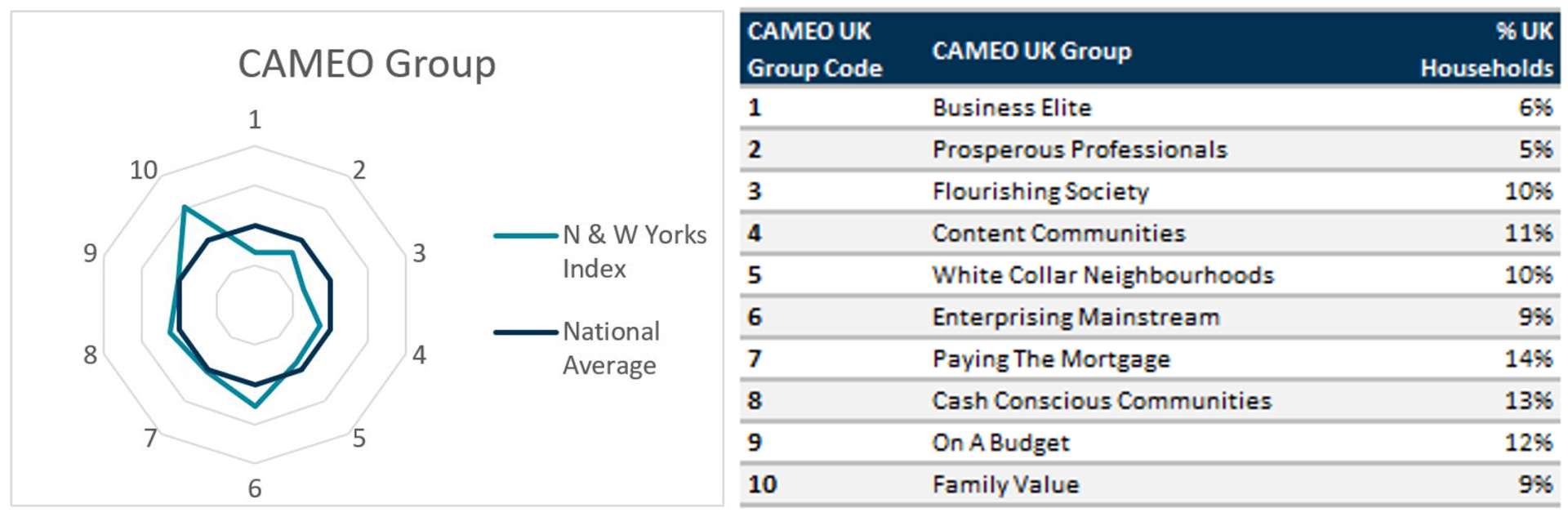

Utilising the CAMEO UK dataset within MVPLUS allows us to quickly test whether Which?’s hypothesis - that deprived communities have less access to cash - is true in our locale. CAMEO UK segments postcodes into 68 distinct categories and 10 aggregated groups. These categories are assigned likely attributes, from age and household income, to online shopping habits and even newspaper preferences! The top 1 to 3 groups are the most well off, whilst the bottom 8 to 10 are the least, with an average household income below £20k.

Compared to the UK, our locale has a higher proportion of groups 6 to 10. Contrary to Which’s statement, our research has found that both nationally and within our region the most deprived CAMEO groups have the best cashpoint and Post Office accessibility. It is those in groups 2 and 3 – ‘Prosperous Professionals’ and ‘Flourishing Society’ – that have the least accessibility. Both these segments are typically: aged 45 and over, live in affluent commuter towns and villages with low population density, are 68% more likely than the UK average to shop online more than once a week, and read the Financial Times and Daily Telegraph!

Although the UK has one of the largest free to use ATM networks in the world, retail banking needs to address the challenge of dispeling public fears over loss of customer service, whilst also making free to use ATMs profitable enough to remain active. As bank branches contiune to shut, banks should see ATMs as an alternative point of contact with their customers. To this end, perhaps the role of the ATM should be re-invented to take on more of the traditional branch based roles, such as 24-hour cash and cheque deposits. Simultaneously, banks should look to spatially re-organise their ATM networks for optimisation. This could prevent further financial exclusion in areas such as Huddersfield, and perhaps reduce the surplus of machines in London.

Studies so far have been undertaken using the geography of Postcode Districts and tend to exclude the location of Post Offices. Postcode Districts are an aggregation of Postcodes, therefore, they have a tendency to mask the intricacies at play. To enable full optimisation and prevent exclusions it is crucial that future studies adopt our methodology and use postcodes as the base geography.

As we have demonstrated in this exploration, GMAP’s MVPLUS system can help you to conduct internal spatial analysis using your own data, CAMEO’s geodemographic segmentation or other data sources. Further insight can be added to your MVPLUS analysis using GMAP’s RetailVision product

or DVLA’s anonymised data set. Furthermore, GMAP’s consultancy services, including Ideal Network Plans, Sales Reporting and Bespoke Analysis, can assist you in addressing your industry challenges by providing actionable geographical insights and solutions. Get in touch for more information at info@gmap.com

or give us a call at 0113 306 1585

We are seeing the media report more and more on the perils of a ‘Cashless Society’ as vendors and consumers favour digital payments over cash. And who could blame our preference? We constantly strive for ease; and online shopping, contactless payments, and mobile applications give us the immediacy we demand. Consequently, ‘cash only’ accounts for 28% of all payments today; ten years ago, it was 60%. Continuing at this rate means the UK will be cashless by 2026. This forecast, coupled with retail banks having to foot an annual £5 billion bill for ATM infrastructure costs, is challenging the economic model. Therefore, like rising costs have given us smaller chocolate bars, the number of bank branches and ATM’s is reducing.

" 'Cash Only' accounts for 28% of all payments today"

Despite our preference for digital payments, 97% of us carry cash. In fact, the average amount is £41! This culminated in 2.4 billion ATM cash withdrawals in 2018, totalling £193 billion. It is no wonder then that a recent UK public opinion poll concluded only 36% of UK adults believed they could cope with going completely cashless. Government advisors are concerned too. They state eight million UK adults (17% of the UK population) would get left behind – just think about the number of cash-in-hand employments: window cleaners, gardeners, labourers, to name a few. Additionally, consumer association Which? fears that deprived neighbourhoods have the least access to cash, even though they are more dependent on it than their affluent counterparts. Thus, it seems the concerns about the so-called ‘Cash Deserts’ are justified, at least for the next 15 years anyway.

In response, LINK – the network that connects the UK’s cash machines and enables universal access to people’s cash – has set up a £1 million fund to pay for 40 to 50 ATM’s requested by residents in the ‘Cash Deserts’. To qualify as a ‘Cash Desert’, areas must not have access to a free to use ATM or Post Office within 1km and the machine must be in a secure locale.

Here at GMAP, we have deployed our MVPLUS

interactive mapping system to investigate how feasible cash access is at postcode level, nationally. To do this we ran a proximity analysis to assess the distance between each postcode and the nearest ATM or Post Office, and appended the 2019 CAMEO

geodemographic dataset to the results. We then compared the 1.4 million households around our locale within the postcode areas of: Bradford (BD), Huddersfield (HD), Harrogate (HG), Halifax (HX), Leeds (LS), Wakefield (WF) and York (YO) to the national picture.

"85% of UK households have an ATM or Post Office within 1km"

Using LINK’s definition, our data shows that 85% of UK households have an ATM or Post Office within 1km. Not surprisingly, the highest accessibility is within London whilst the most Northern areas of Scotland have the least – 44% in the Northern Hebrides. For our locale, the coverage is below the national average at 73%. This means approximately 360,000 households are classified as ‘Cash Deserts’. For households not in a ‘Cash Desert’, the average travel distance is ½ km across all postcode areas, except for York which is nearer 400 metres. If we look at the individual postcode areas, there is a fair amount of variation; households with a Leeds postcode have the most accessibility to cash at 79%, whilst those in Huddersfield only have 62% - the lowest cash accessibility within England! Interestingly, had LINK set the qualification threshold at 2km, only 6% of households nationally would be in a ‘Cash Desert’ and 8% within our region.

Utilising the CAMEO UK dataset within MVPLUS allows us to quickly test whether Which?’s hypothesis - that deprived communities have less access to cash - is true in our locale. CAMEO UK segments postcodes into 68 distinct categories and 10 aggregated groups. These categories are assigned likely attributes, from age and household income, to online shopping habits and even newspaper preferences! The top 1 to 3 groups are the most well off, whilst the bottom 8 to 10 are the least, with an average household income below £20k.

Compared to the UK, our locale has a higher proportion of groups 6 to 10. Contrary to Which’s statement, our research has found that both nationally and within our region the most deprived CAMEO groups have the best cashpoint and Post Office accessibility. It is those in groups 2 and 3 – ‘Prosperous Professionals’ and ‘Flourishing Society’ – that have the least accessibility. Both these segments are typically: aged 45 and over, live in affluent commuter towns and villages with low population density, are 68% more likely than the UK average to shop online more than once a week, and read the Financial Times and Daily Telegraph!

Although the UK has one of the largest free to use ATM networks in the world, retail banking needs to address the challenge of dispeling public fears over loss of customer service, whilst also making free to use ATMs profitable enough to remain active. As bank branches contiune to shut, banks should see ATMs as an alternative point of contact with their customers. To this end, perhaps the role of the ATM should be re-invented to take on more of the traditional branch based roles, such as 24-hour cash and cheque deposits. Simultaneously, banks should look to spatially re-organise their ATM networks for optimisation. This could prevent further financial exclusion in areas such as Huddersfield, and perhaps reduce the surplus of machines in London.

Studies so far have been undertaken using the geography of Postcode Districts and tend to exclude the location of Post Offices. Postcode Districts are an aggregation of Postcodes, therefore, they have a tendency to mask the intricacies at play. To enable full optimisation and prevent exclusions it is crucial that future studies adopt our methodology and use postcodes as the base geography.

As we have demonstrated in this exploration, GMAP’s MVPLUS system can help you to conduct internal spatial analysis using your own data, CAMEO’s geodemographic segmentation or other data sources. Further insight can be added to your MVPLUS analysis using GMAP’s RetailVision product

or DVLA’s anonymised data set. Furthermore, GMAP’s consultancy services, including Ideal Network Plans, Sales Reporting and Bespoke Analysis, can assist you in addressing your industry challenges by providing actionable geographical insights and solutions. Get in touch for more information at info@gmap.com

or give us a call at 0113 306 1585