A Deep Drive into the SUV Market

20th May 2024

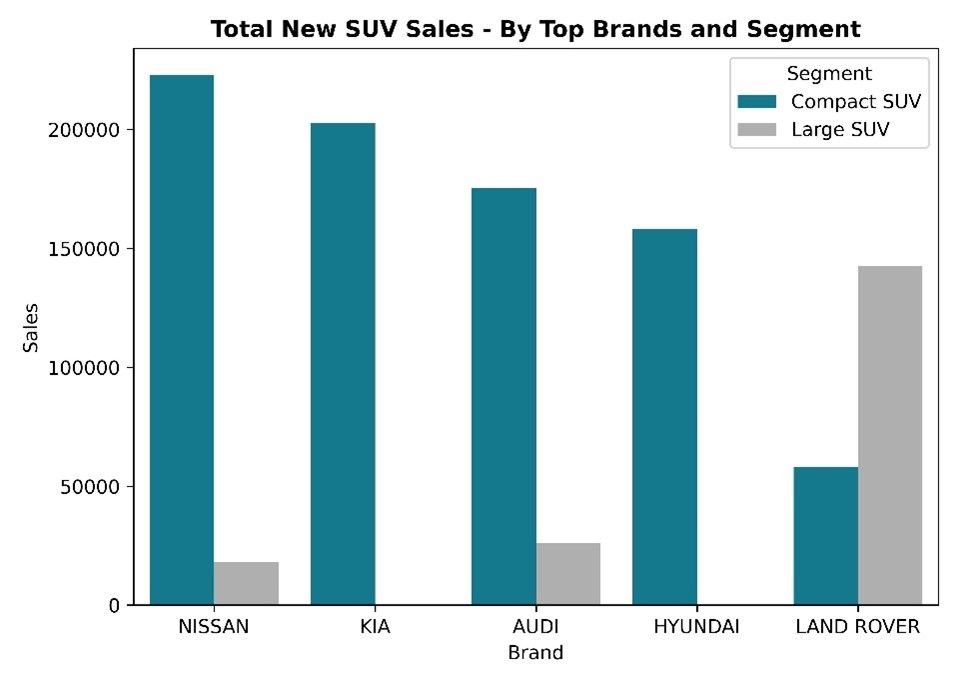

As experts in the automotive location planning industry, at GMAP, we thrive on exploring trends and changes in the automotive sector through our use of DVLA Data. Having been resellers of the anonymized DVLA car registrations dataset for the past decade, we have conducted numerous geodemographic analyses within automotive location planning projects and supplementing projects in the retail industry.

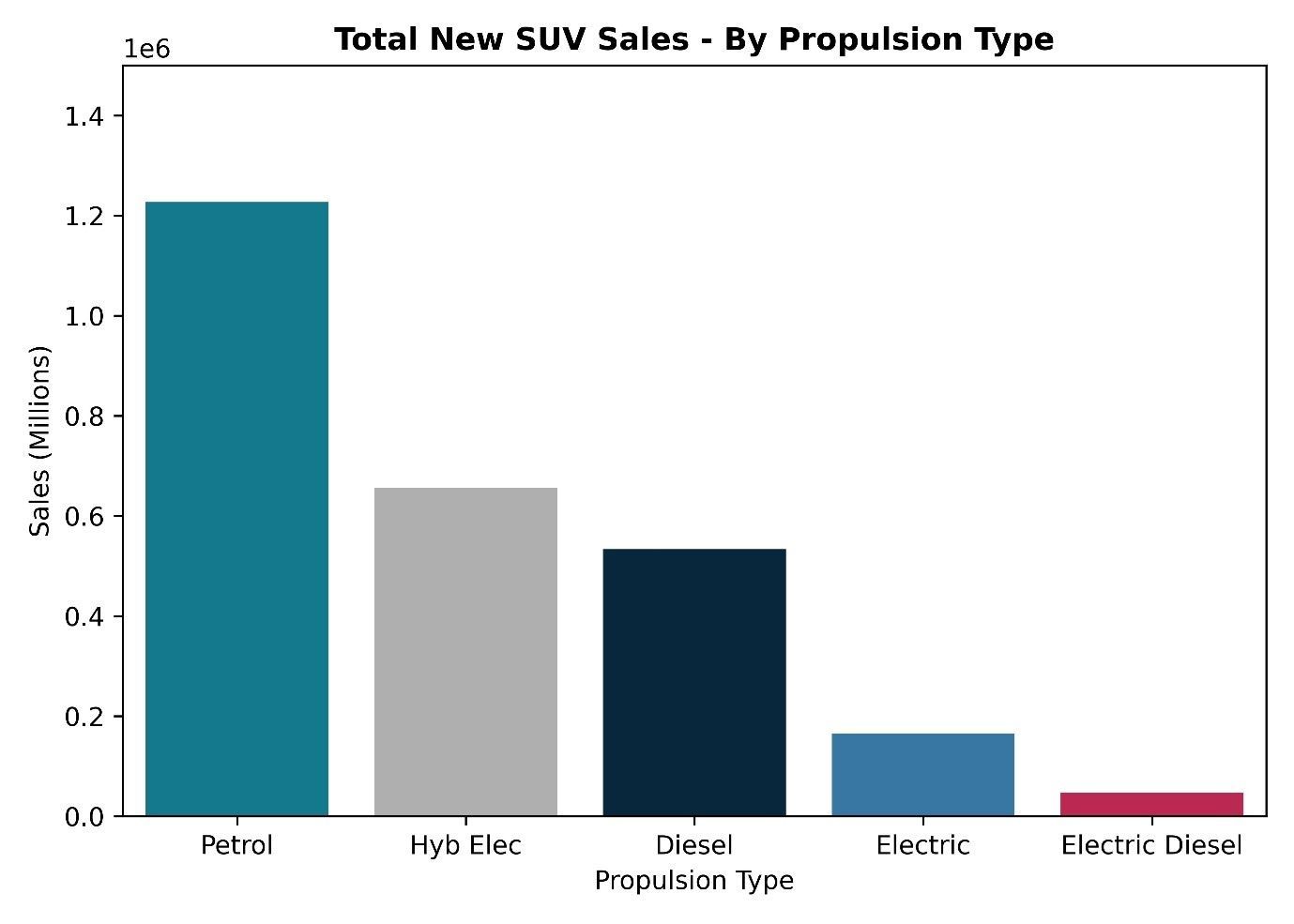

This analysis will focus on new SUV vehicles (Sports Utility Vehicles) in the UK, a sector of the automotive industry which has seen significant change and rising popularity in the modern automotive markets. The growing popularity of SUVs is likely a consequence of multiple factors including: increasing car finance options; increasing demand for electric vehicles (which are commonly SUVs); and their perceived comfort and luxury.

The SUV Market Summarised

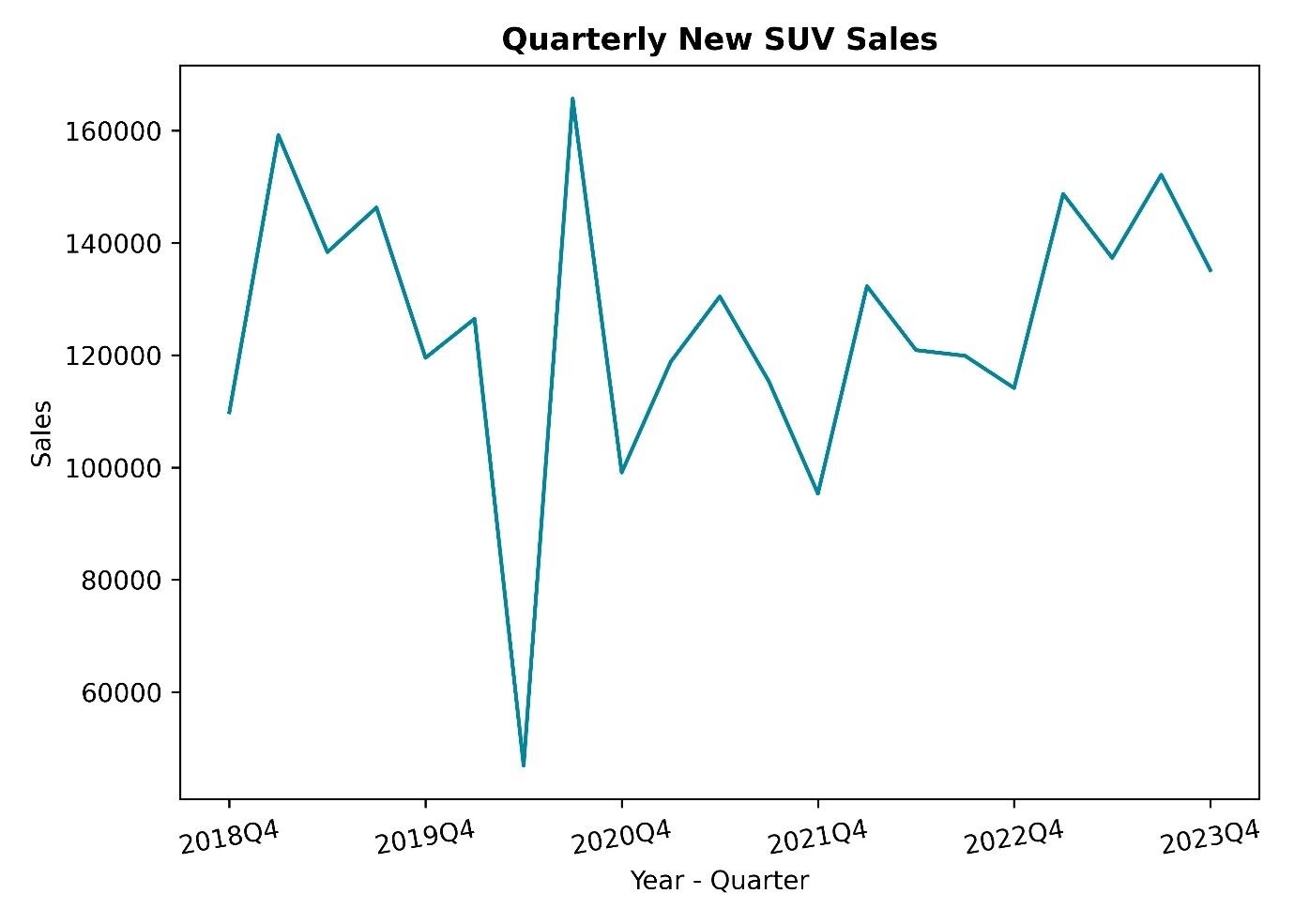

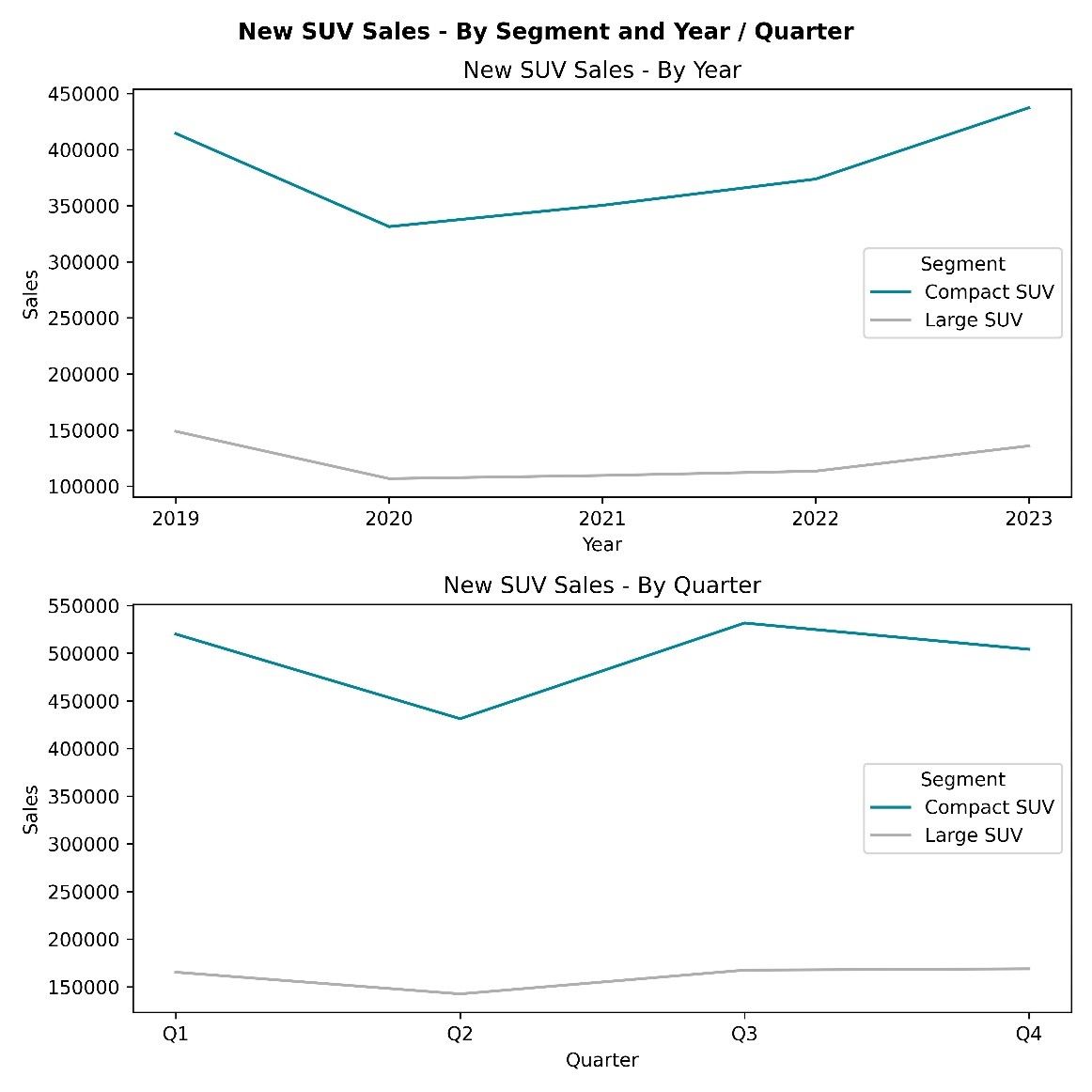

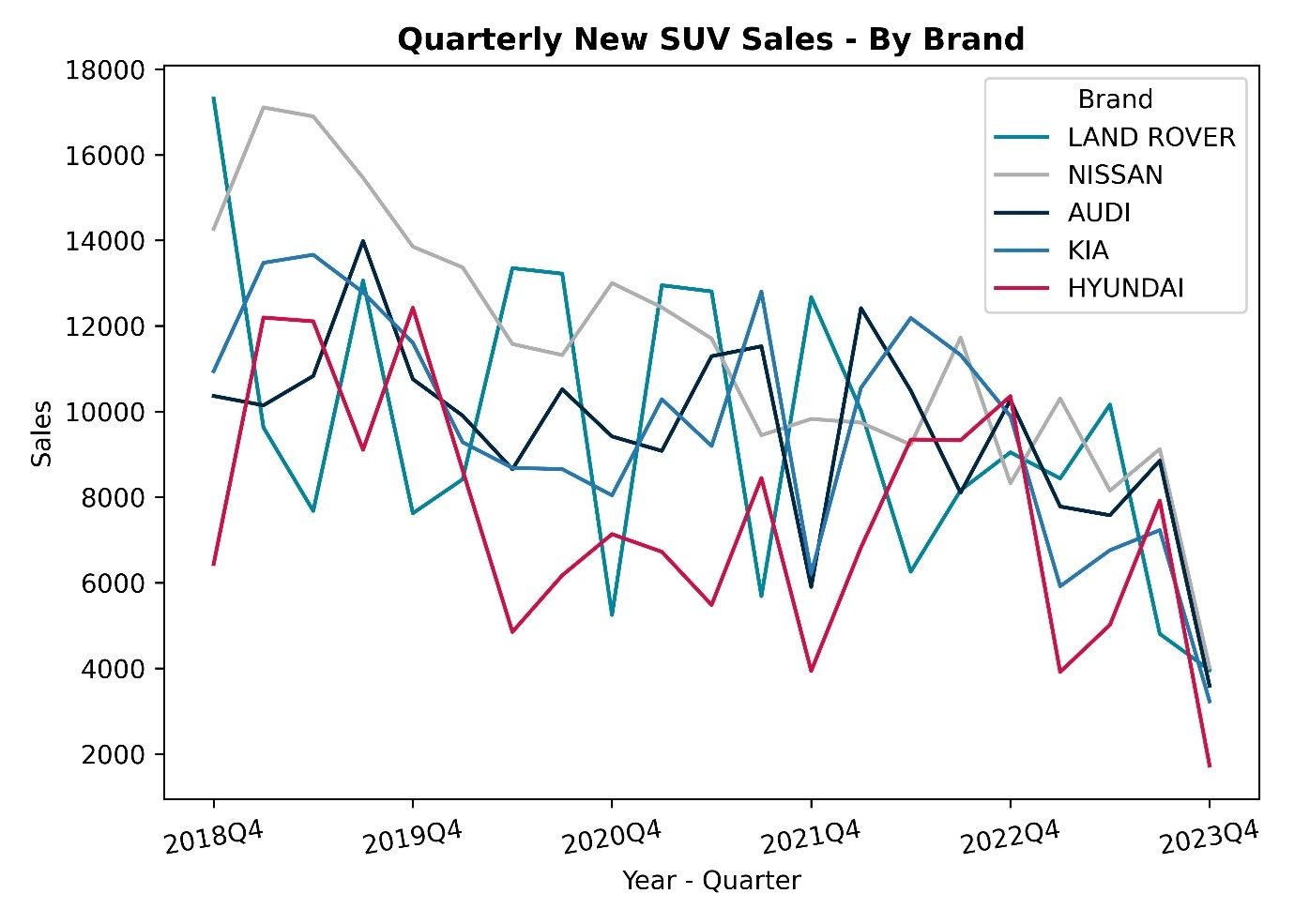

The SUV Market over time

Our Thoughts